Contents

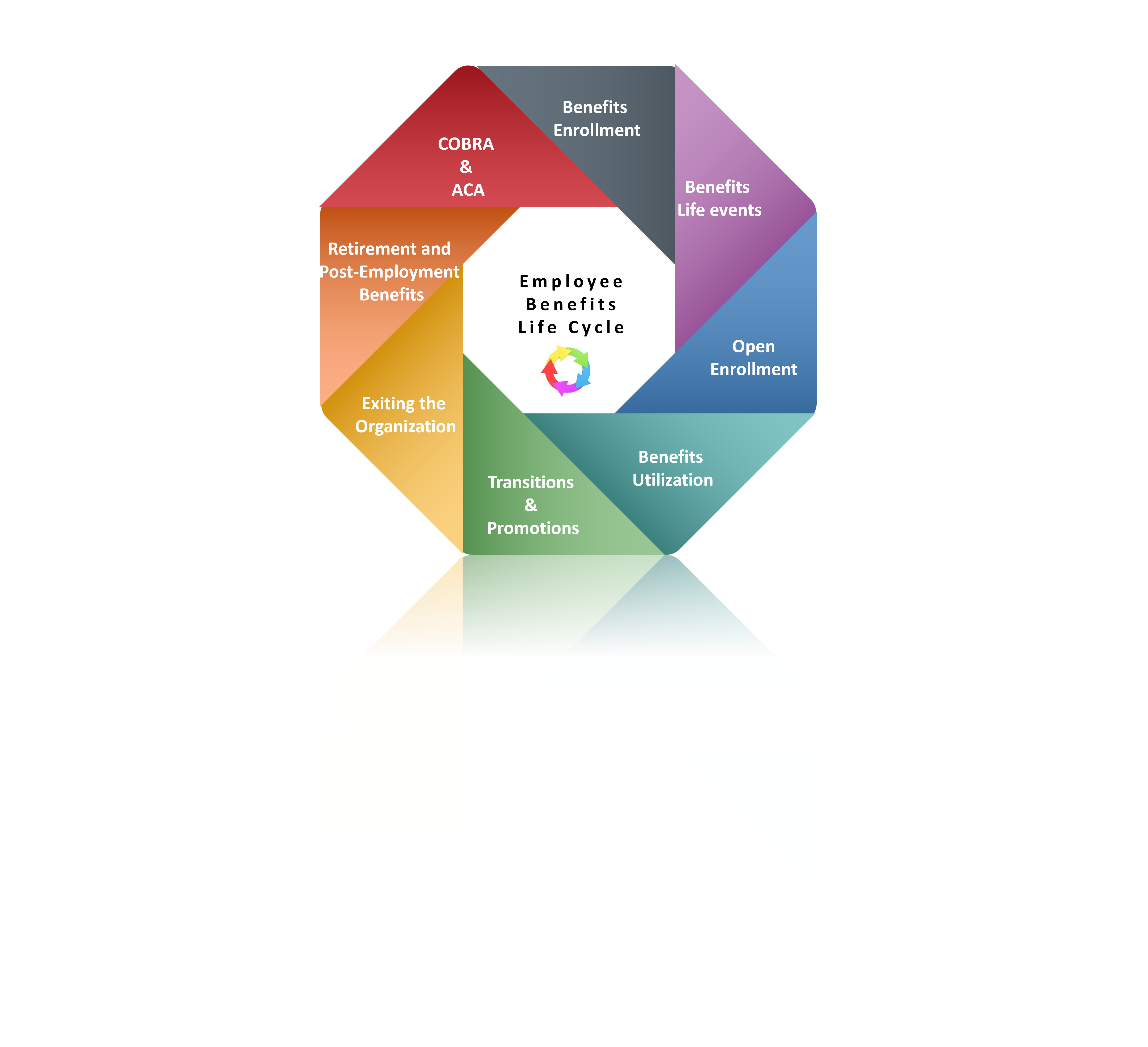

The employee benefits lifecycle

The employee benefits lifecycle refers to the various stages and processes throughout an employee’s tenure with a company about their benefits package. It encompasses everything from initial benefits enrollment to the termination of benefits upon the employee’s departure.

Broadly employee Benefits can be divided into two major segments traditional and non-traditional. Traditional benefits are the standard offerings provided by employers to employees, including health insurance, retirement plans, paid time off, disability insurance, life insurance, and employee assistance programs.

On the other hand, non-traditional benefits are additional perks and incentives to enhance work-life balance, well-being, and job satisfaction. These benefits include flexible work arrangements, wellness programs, childcare assistance, paid volunteer time, professional development opportunities, financial planning resources, and more. While traditional benefits are expected in most workplaces, non-traditional benefits help companies stand out, attract top talent, and foster a positive work culture.

The critical stages of the employee benefits lifecycle

Here are the critical stages of the employee benefits lifecycle:

Benefits Enrollment: When new employees join a company, they are typically provided information about the benefits offered. This stage involves educating employees about available benefits and guiding them through enrollment.

During benefits enrollment, companies may offer non-traditional benefits options that employees can choose from, depending on their preferences and needs.

Examples of non-traditional benefits include:

- Flexible Work Arrangements: This could include remote work, flextime, compressed workweeks, or job sharing, which empower employees to have greater control over their work schedules.

- Wellness Programs: Companies may provide access to wellness programs that offer fitness classes, meditation sessions, mental health support, or health coaching to promote employee well-being.

- Childcare Assistance: Employers may offer childcare support, such as on-site daycare facilities or subsidies for external childcare services, to help working parents manage their family responsibilities.

- Financial Planning and Education: Financial planning resources and workshops can help employees manage their finances and plan for the future.

Active Employment: During employment, employees enjoy the benefits they have enrolled in, such as health insurance, retirement plans, paid time off, and other perks.

Throughout their employment, employees can take advantage of non-traditional benefits that contribute to their job satisfaction and work-life balance:

- Employee Assistance Programs (EAPs): EAPs offer confidential counseling and support services to help employees address personal and work-related challenges.

- Paid Volunteer Time: Companies may offer paid time off for employees to volunteer and contribute to causes they are passionate about.

- Professional Development Opportunities: Investing in employees’ growth by offering workshops, courses, or mentorship programs can enhance their skills and job satisfaction.

Benefits Life Events and Changes: Employees may experience life events that necessitate changes to their benefits. For example, getting married or having a child might prompt them to update their health insurance coverage or add dependents to their plan.

Non-traditional benefits can also come into play during significant life events and changes:

- Parental Support: Companies might offer extended parental leave, paid adoption assistance, or resources for new parents to support them during this life-changing event.

- Elder Care Assistance: Some employers provide resources or referral services to help employees navigate elder care responsibilities for their aging family members.

Open Enrollment Periods: Employers usually offer open enrollment periods once a year, during which employees can review their current benefits, adjust, or choose new options for the upcoming year.

Benefit Utilization: Throughout their employment, employees use their benefits as needed. For instance, they might visit healthcare providers, contribute to their retirement accounts, or take advantage of flexible spending (FSAs) or health savings accounts (HSAs).

Employees can actively utilize non-traditional benefits to enhance their work experience and well-being:

- Work-Life Balance Initiatives: Employees may participate in company-sponsored events, team-building activities, or social gatherings to foster a positive work environment.

- Health and Fitness Perks: Access to gym memberships, fitness challenges, or healthy snacks in the workplace can promote employees’ physical health.

Leaves of Absence: When employees take leave of absence, such as parental or medical leave, the management of their benefits may differ from their usual active employment status.

Transitions and Promotions: If employees change roles within the company or receive a promotion, their benefits package might be adjusted to align with their new position.

Exiting the Company: When employees leave the company, whether, through retirement, resignation, or termination, their benefits coverage may change or end altogether. They may be eligible for certain benefits during a transition period or under specific circumstances (e.g., COBRA continuation coverage in the U.S. for qualified events).

Retirement and Post-Employment Benefits: For retiring employees, companies may offer additional benefits or assistance, such as pension plans, retiree health benefits, or access to financial planning resources.

Affordability Care Act (ACA): ACA has significantly impacted how employers manage and administer health insurance benefits throughout the employee benefits lifecycle, from initial enrollment to post-employment coverage options. Compliance with ACA regulations is crucial for employers to avoid penalties and provide their employees with comprehensive health insurance options.

COBRA (Consolidated Omnibus Budget Reconciliation Act): In the United States, employers with 20 or more employees are typically required to offer COBRA coverage, allowing former employees and their dependents to continue their group health insurance for a limited time after leaving the company. Employers must ensure that their COBRA administration complies with ACA requirements to provide continuation coverage that meets the ACA’s standards for essential health benefits and affordability.

Managing the employee benefits lifecycle requires effective communication, proper administration, compliance with relevant regulations, and technology and Benefits systems to streamline the process. Employers often work with HR departments, benefits administrators, and third-party vendors to manage these complex processes and ensure employees receive the benefits they are entitled to throughout their employment journey.

Benefits Reimagined provides comprehensive support throughout the entire employee benefits lifecycle, encompassing both traditional and non-traditional employee benefits.

- The employee benefits lifecycle - 04/08/2023

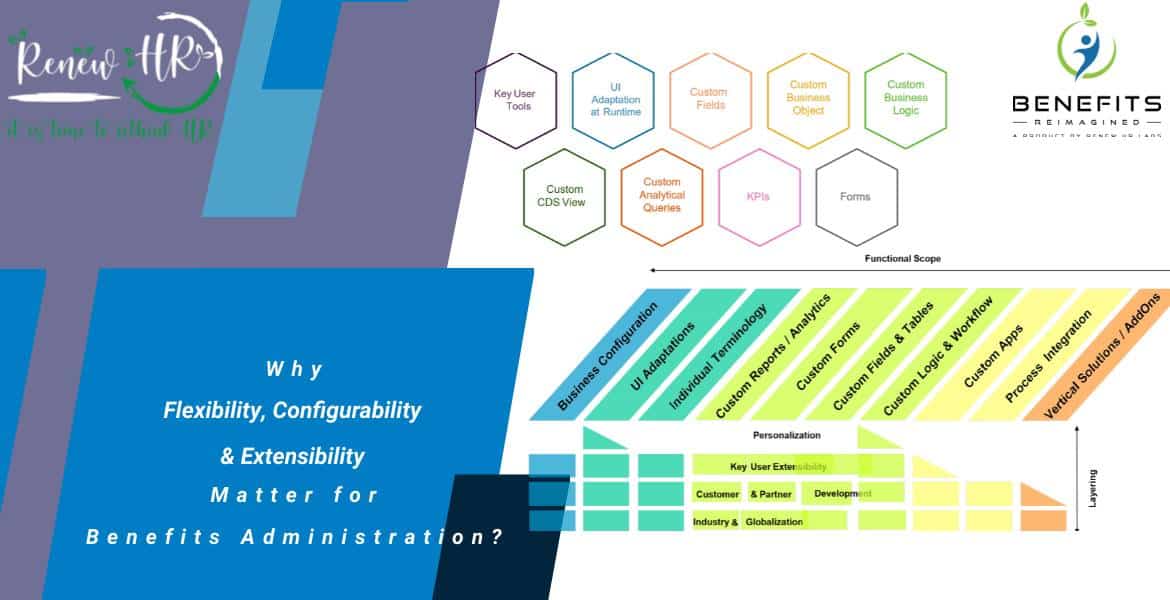

- Why Flexibility, Configurability & Extensibility matter for Benefits Administration? - 02/08/2023

- The communication challenges - 31/07/2023